Service Expense

Frequently Asked Questions

Section titled “Frequently Asked Questions”Does a service expense affect the total order amount?

No, it does not affect the amount payable by the client

The order total is calculated only from the cost of goods and services

Does a service expense affect employee salaries?

No, it does not affect salary calculation

Salaries are calculated as a percentage of:

- Net profit from goods/services

- Order creation fee

Will a service expense impact profit reports?

No, it does not affect net profit

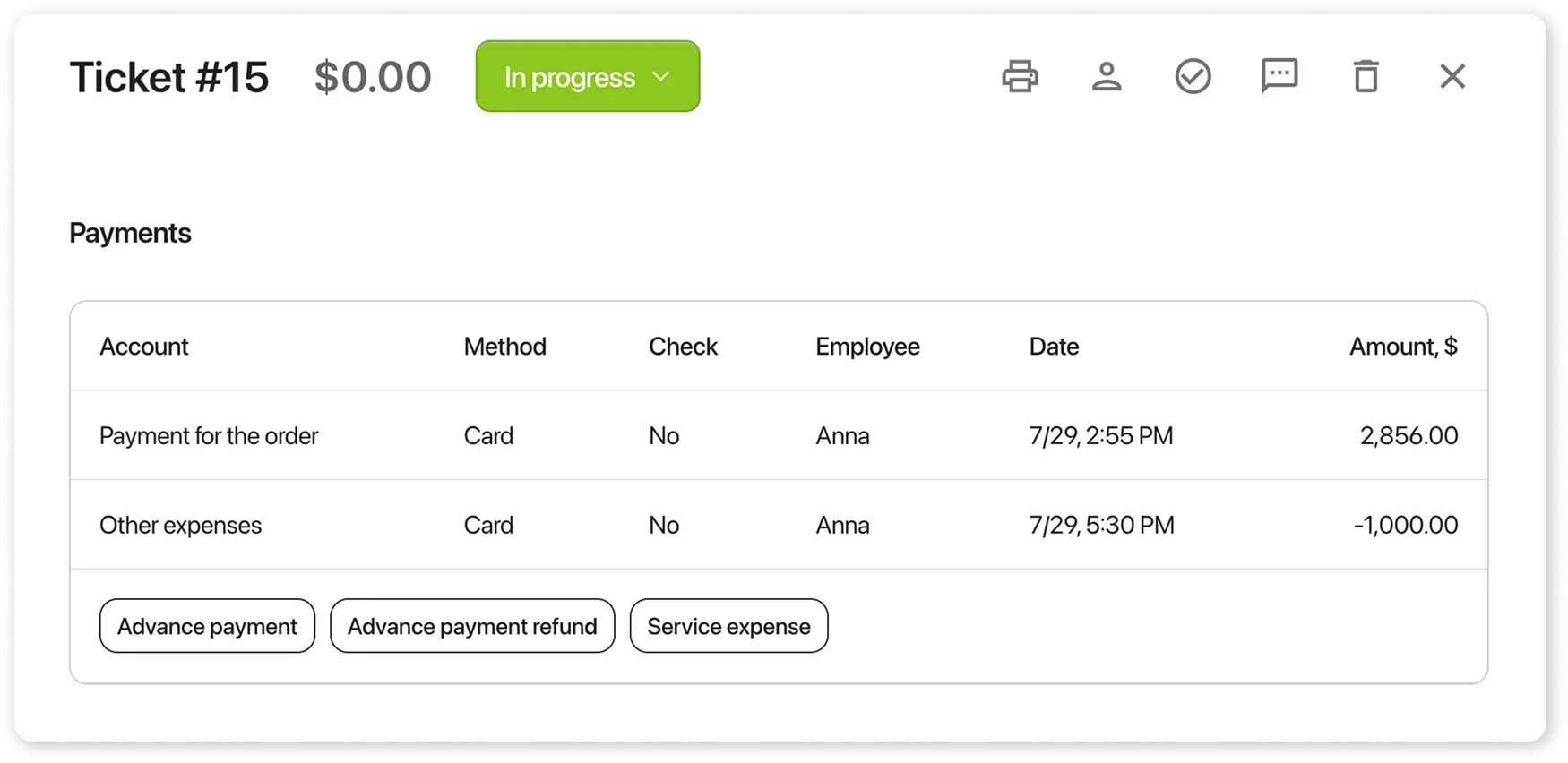

It will appear in the balance under the Payments section

What is the purpose of a service expense?

Section titled “What is the purpose of a service expense?”Sometimes a company takes on additional costs as part of fulfilling order, which should not affect the total price charged to the client.

For example: courier services, purchasing a part, etc.

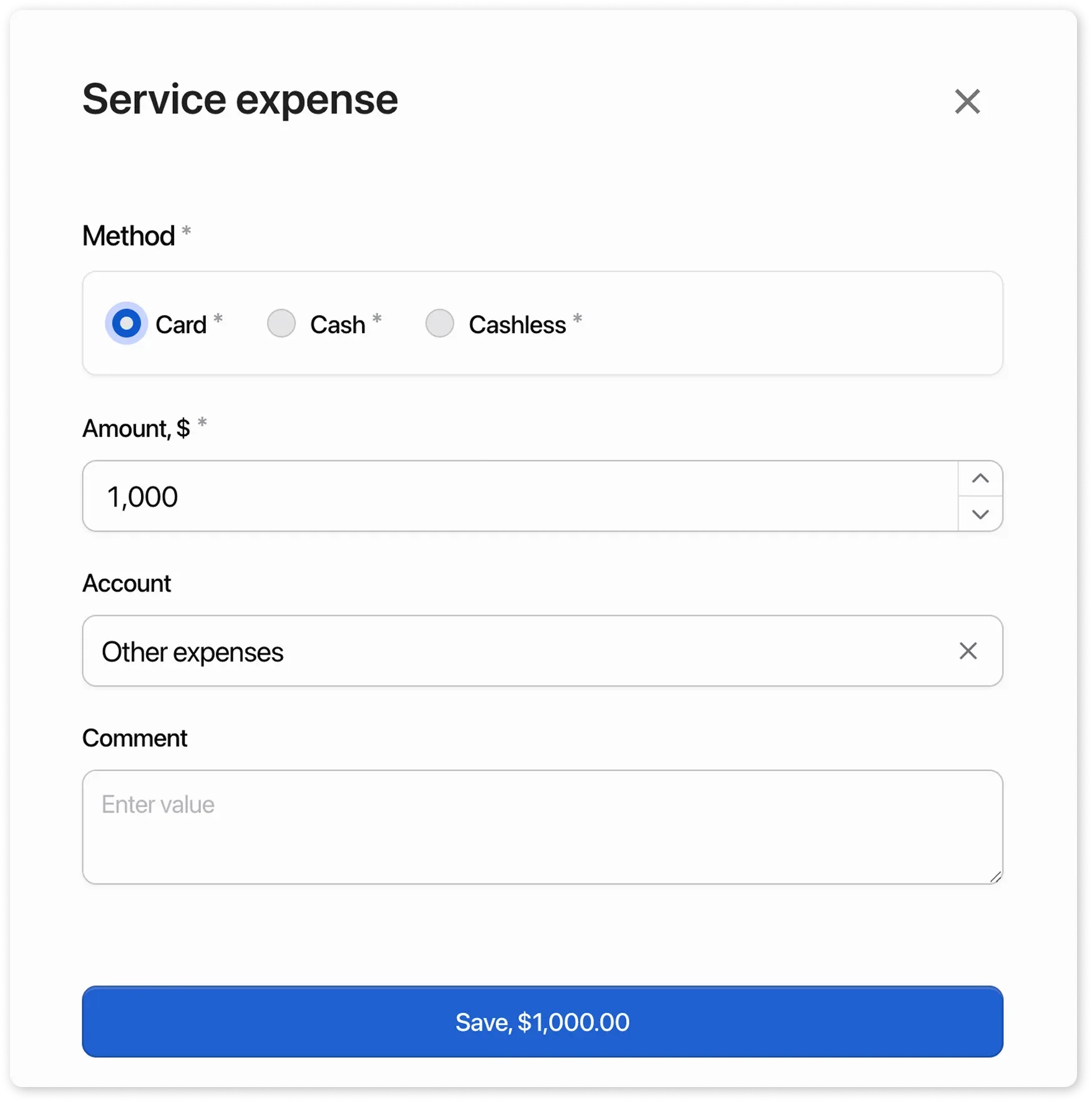

How and where to create a service expense?

Section titled “How and where to create a service expense?”When you urgently need to purchase a part and don’t have time to register the item in inventory, but still want to record the expense (like for courier service or part purchase), you can add a service expense directly in the order card

The service expense information will be shown in the order history. It will also automatically appear in Payments as an expense deducted from your balance and linked to the order.

Creating a service expense will not affect:

Section titled “Creating a service expense will not affect:”- The amount the client owes you for the order (the total order amount comes only from goods and services)

- Employee salaries (salaries are calculated as a percentage of net profit from goods and services and from order creation)

- Net profit from the order

Real examples of using service expenses:

Section titled “Real examples of using service expenses:”- Adding a one-time part to the order

For example, you add a one-time-use part to the order with a price of ₽1,000 and a cost of ₽500. In this case, you should add a service expense for ₽500. If you don’t, the system will show a profit of ₽1,000, which is incorrect, since you spent ₽500 on the part.

- The company covers the expense

Suppose you completed a client’s order for ₽3,000 but missed the deadline. You decide to send the order by courier. You add a service expense called “Delivery” costing ₽500. This expense will be reflected in your balance, but the client still owes you ₽3,000. The service expense will not affect your company’s net profit from the order or employee salaries.

- Client covers the service expense

If you regularly provide courier delivery and want the client to pay for it, you need to either:

- Add the service expense amount to the price of another service in the order, or

- Add a one-time service with the proper price and cost.