Payment tags

Frequently Asked Questions

Section titled “Frequently Asked Questions”Missing a necessary income or expense tags?

If the tags you need is not available, please contact our support chat. We’ll help you choose the appropriate income or expense tags and also consider adding new categories to the system.

Why can’t I create or edit custom tags?

To prevent errors in the payment system and ensure correct reporting, creating or editing custom tags is not allowed.

When creating an income or expense transaction, you must select a tag from the predefined list.

If you need to split payments under the same tag, please clarify in the comments. For example, when creating an internal expense with the tag “Product Purchase,” you can add specific details in the comment — this will make it easier to locate the transaction later.

How do income and expense tags work?

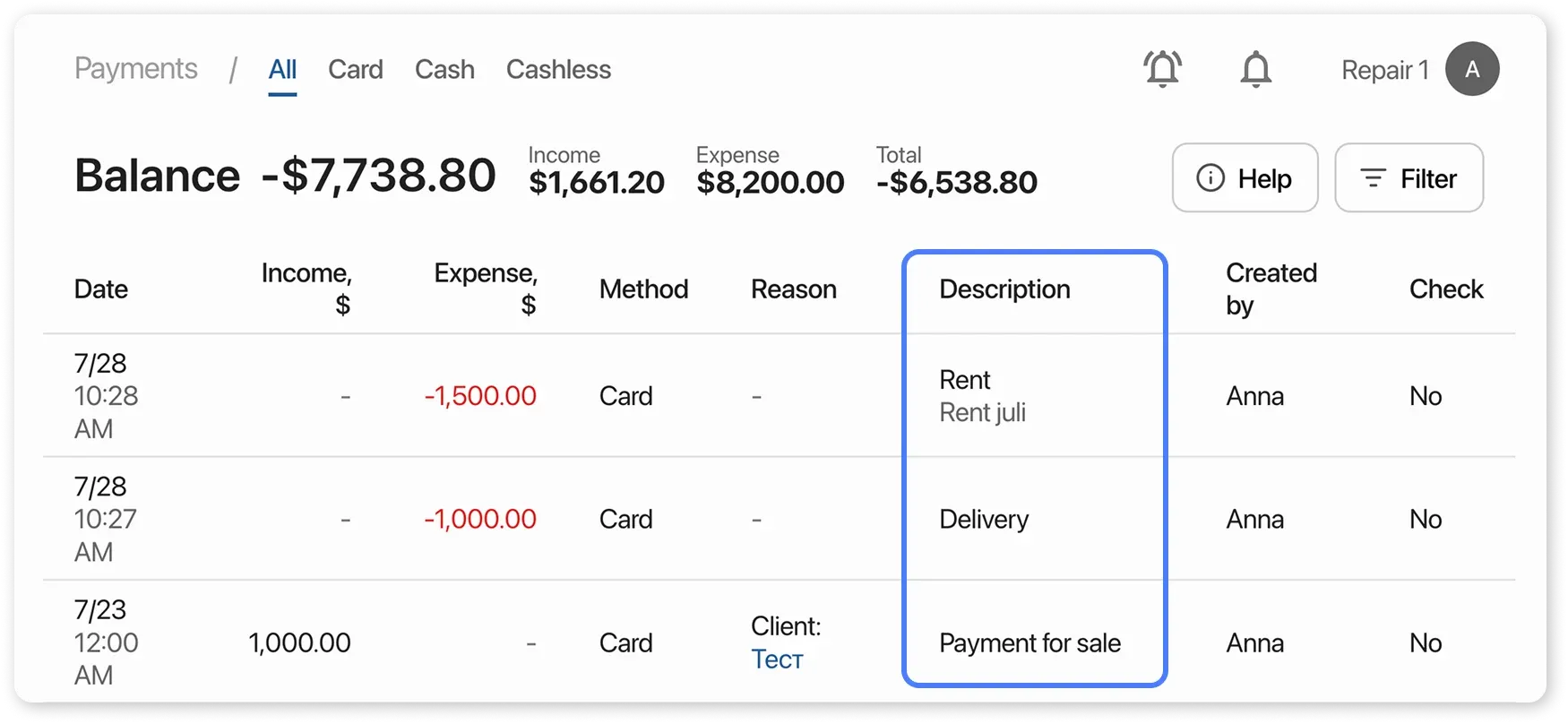

Section titled “How do income and expense tags work?”Every financial transaction in HelloClient is linked to an income or expense tag. This enables you to analyze financial flows by category.

Selecting an expense tag for a payment

Section titled “Selecting an expense tag for a payment”System tag are predefined for tracking financial transactions. Using them helps to:

- Display accurate figures in reports

- Avoid operational errors

- Ensure no transaction is lost

Types of tags:

Section titled “Types of tags:”1. Automatic for System Payments

Section titled “1. Automatic for System Payments”These payments impact the company’s profit, so they must be recorded correctly.

-

Order Payment Final payment from the client for an order

-

Prepayment

Advance payment from the client before order fulfillment

-

Prepayment Refund

Refund of the client’s advance payment

-

Order Refund

Refund for a completed and paid order

-

Sales Payment

Retail sale payment through the Store module

-

Sales Refund

Refund for an item sold via the Store module

-

Product Purchase

Goods entered directly from the product card

-

Supplier Payment

Used when receiving goods from a supplier order

-

Salary Payment

Salary payment recorded through the “Payroll” report

2. Frequently Used tags

Section titled “2. Frequently Used tags”These categories are meant for convenience and consistency in manual or internal payments.

They impact the company’s profit and should be accurately recorded.

Examples include: rent, delivery, advertising, consumables, client buyout, etc.

3. Internal Cash Flow tags

Section titled “3. Internal Cash Flow tags”Cash Deposit

Used for:

- Adding change

- Depositing cash into the register

Cash Withdrawal

Used for:

- Cash collection

- End-of-shift cash withdrawal to a safe

Funds Transfer

Used for:

- Transferring money between cash registers (e.g., from cash to non-cash)

How to Use Categories

Section titled “How to Use Categories”- Automatic system tags are applied automatically by the system.

- Frequently used tags are selected manually when creating payments in the “Payments” section or internal expenses.

- Internal cash flow tags are selected manually in the “Payments” section.

If you need to split transactions under the same tag, please include a comment. For example, when recording an internal expense under “Product Purchase,” add details to the comment to make it easier to find later.

How to Link a tags to a Transaction

Section titled “How to Link a tags to a Transaction”Example: For an expense to buy printer paper:

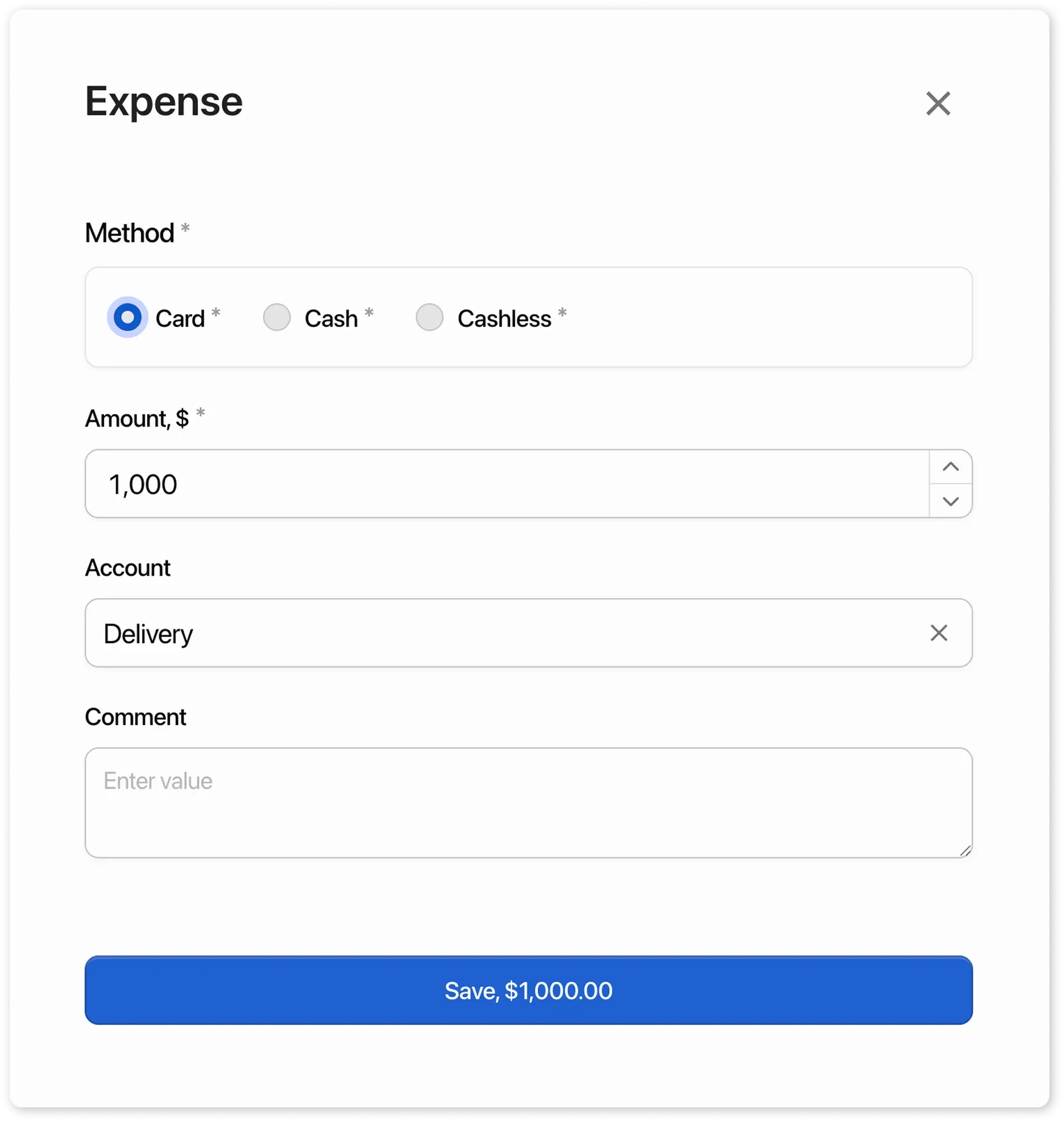

- In the “Payments” section, click Expense.

- Enter the amount and choose the tag - Office Expenses.

- Save the transaction.

Now all office-related expenses can be filtered and analyzed by date or tags.